are hearing aids tax deductible in canada

Youll also need to claim the corresponding tax credit on your provincial schedule. This includes people earning 84000 as a single person or.

Tax Deductible Medical Expenses In Canada Groupenroll Ca

In some cases wearers of hearing aids may also be able to benefit from the earned.

. Medical expenses may be one of the most under-utilized tax credits says Hamilton Ontario accountant Alan Rowell. Since hearing loss is considered a medical condition and hearing aids are medical devices regulated by the FDA you may be able to deduct these costs. Deducting the cost of hearing aids from your taxable income can lower the amount you pay.

After 2018 the floor returns to 10. To get a full understanding of those expenses here is the list. Other hearing assistance items that are deductible include televisions and related accessories that amplify sound guide dogs including veterinary grooming and food expenses particular smoke detectors doorbells and burglar.

Are Hearing Aids Tax Deductible in Canada. The short and sweet answer is yes. The list of eligible expenses you can claim is extensive.

Claiming deductions credits and expenses. Even the Canada Revenue Agency stresses that its own list isnt exhaustive so chances are your significant medical expenses qualify when filing your taxes. Deducting the cost of hearing aids from your taxable income can lower the amount you pay for hearing aids by as much as 35 percent.

You can purchase the latest hearing aids at a fair price through HearingSol If you need more information or you have a query about Hearing Aid or Hearing Loss just give us a call. Eligible Hearing Aid Expenses For Tax Deduction. Hearing aids on average cost between about 1000 and 4000.

Expenses related to hearing aids are tax. If you have severe or profound hearing loss the DTC may offset some of the costs related to the impairment by reducing the amount of income tax you may have to pay. For example if your adjusted gross income is 50000 you can deduct the cost of any allowable medical expenses that exceed 3750.

Tax season is upon us and every year we ask ourselvesIs this tax deductible. Not only can you deduct the cost of your hearing aids but the doctors appointments audiologist and the cost of testing can all be deducted. Medical expenses in general can typically be deducted at the end of the year so long as they match or exceed 75 of your annual income.

Even the hearing aid batteries are tax-deductible. You would claim the amount in this section to receive the tax-deductible related to the purchase of the hearing aids. Expenses related to hearing aids are tax.

While this puts hearing aids beyond many peoples typical monthly budget there are actually quite a few ways that these costs can be controlled. To calculate your tax-deductible for medical expenses in Canada you subtract 3 of your net income or 2397 whichever is the lesser of the two amounts from your total eligible medical expenses for that year. Hearing aids and accessories are eligible for tax credits as long as either you or your spouse paid for them within the past year and will not be reimbursed by your private insuranceWhen you file your taxes you will need to list your out-of-pocket expenses on line 330 of the tax return.

Especially when it comes to medical expenses the list of expenses you can claim on your tax return feels endless. Turbo tax a popular tax preparation software also ensure that hearing aids are tax-deductible. After 2018 the floor returns to 10.

Are hearing aids tax-deductible in UK. Hearing aids batteries maintenance costs and repairs are all deductible. Income tax rebate for hearing aids.

For employees hearing aids or similar disability equipment provided by companies will qualify for full corporate tax relief without incurring any additional. NexGen Hearing is here to help you understand whether or not hearing aids. The high cost of hearing aids can mean that millions of Americans avoid buying a hearing device because they can.

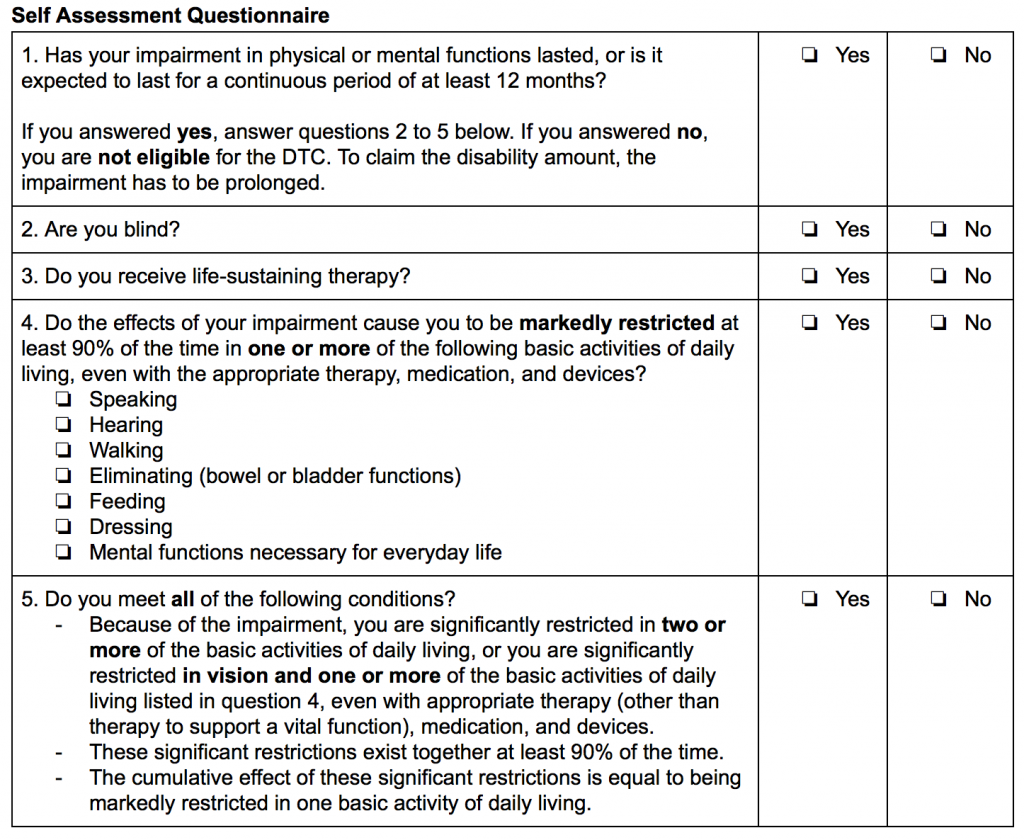

Eligibility for the DTC is based on the effects of an impairment not a diagnosis or the presence of. In many cases hearing aids are tax-deductible. Even the hearing aid batteries are tax-deductible.

A long list of medical expenses are tax-deductible in Canadadepending on how much you paid for your medical expenses you may be eligible for a refundable tax credit that can make a significant difference in your annual tax bill. They come under the category of medical expenses. In the eyes of the federal government virtually all personal medical expensesincluding hearing aidscan potentially qualify for a tax deduction.

You can calculate the amount youre allowed to take on Schedule A Form 1040 or 1040-SR. In order for hearing aids or other medical expenses to qualify as tax-deductible the total cost of all medical expenses will need to be greater than 75 percent of your adjusted gross income this includes batteries insurance and all other related expenses. If you have travel expenses related to medical services and you also qualify for northern residents deductions line 25500 of your return.

All the costs related to the hearing aids depend on whether you purchased paying the full amount or. Now that you know hearing aids are tax-deductible in Canada you have to understand what expenses are eligible for deduction of tax. Contact lenses eyeglasses hearing aids and batteries as well as guide dogs for the blind or deaf are all.

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. You can purchase the latest hearing aids at a fair price through HearingSol If you need more information or you have a query about Hearing Aid or Hearing Loss just give us a call on 91-9899437202. Tax offsets are means-tested for people on a higher income.

Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay. Hearing aids on average cost between about 1000 and 4000. By deducting the cost of hearing aids from their taxable income wearers could reduce the cost of their hearing aids by up to 35.

Many of your medical expenses are considered eligible deductions by the federal government. Hearing aids or personal assistive listening devices including repairs and batteries. You can only deduct the amount of the total that exceeds 75 of your adjusted gross income.

Smart Year End Tax Moves To Make Right Now

Are Hearing Aids Tax Deductible In Canada Nexgen Hearing Clinics

Disability Tax Credit Davidson Hearing Aid Centres

Is Health Insurance A Taxable Benefit In Canada Explained Groupenroll Ca

What Qualifies As Medical Expenses When Filing Taxes 2022 Turbotax Canada Tips

10 Tax Credits To Be Aware Of In Canada

Disability Tax Credit Speech Language Audiology Canada

Medical Expenses Often Overlooked As Tax Deductions Cbc News

Medical Expenses You Can Claim On Your Canadian Income Tax Return Canadian Budget Binder

What Qualifies As Medical Expenses When Filing Taxes 2022 Turbotax Canada Tips

Disability Tax Credit Application Information For Deaf And Deafness Patients

Most Overlooked Tax Breaks Cbc News

Financial Assistance Options For Hearing Aids Le Groupe Forget

Types Of Hearing Loss Treatment And Hearing Aids In Canada

5 Things You Didn T Know You Could Claim On Tax Returns Ctv News

Canada S Medical Expense Tax Credit A Comprehensive Guide Groupenroll Ca

Are Hearing Aids Deductible In Canada

Canada S Medical Expense Tax Credit A Comprehensive Guide Groupenroll Ca