owner's draw in quickbooks self employed

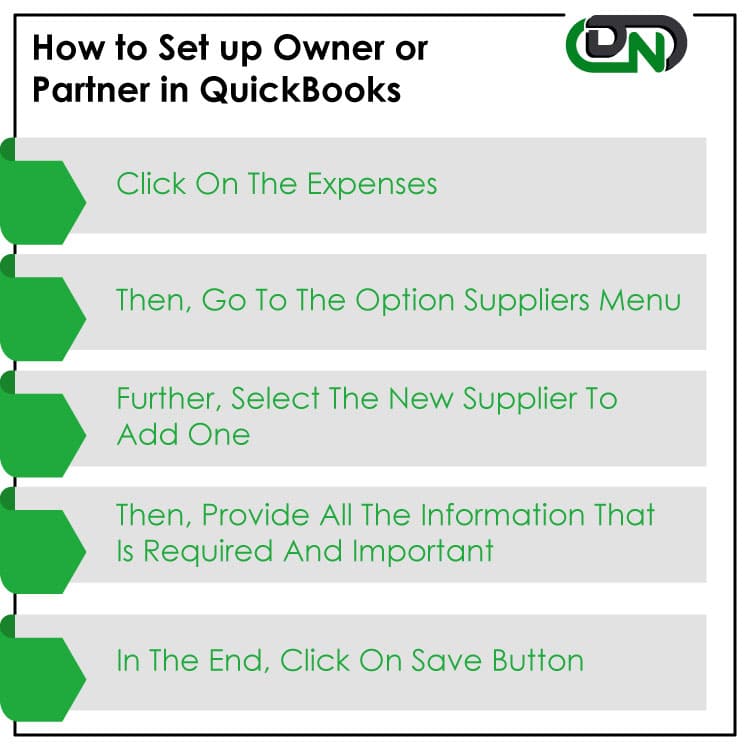

At the bottom left choose Account New. Here are few steps given to set up the owners draw in QuickBooks Online.

How Do I Pay Myself Owner Draw Using Direct Deposi

The best way to do it would be to go back and change the expense account from Owners Personal Expenses to Owners Draw equity account for each transaction if there.

. Manage All Your Business Expenses In One Place With QuickBooks. Dont forget to like and subscribe. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

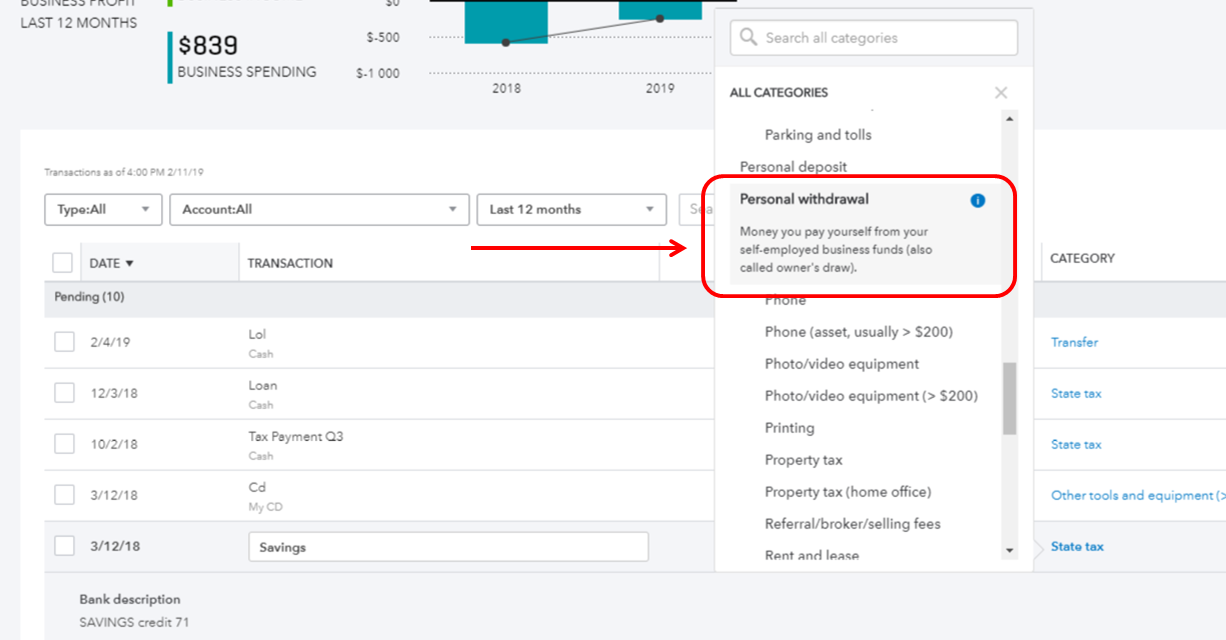

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. When recording an owners draw in QuickBooks Online youll need to create an equity account. An owners draw also called a draw is when a business owner takes funds out of their business for personal use.

Setting Up an Owners Draw Account. To Write A Check From An Owners Draw Account the steps are as follows. Ad Save Over 51 Hours Per Month On Average By Using QuickBooks.

To create an owners draw account. Open the QuickBooks Online application and click on the Gear sign. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

This leads to a reduction in your total share in the business. Before you can pay an owners draw you need to create an Owners Equity account first. Setting Up an Owners Draw.

The draws do not include any kind of taxes including self. An owner of a sole. To create an owners.

1 Create each owner or partner as a VendorSupplier. The owners draw is the distribution of funds from your equity account. A draw is simply a cash withdrawal that reduces the ownership investment you have made in your company.

Create an Owners Equity account. Now hit on the Chart of Accounts option. If youre interested in learning more about owners draw and how to set them within Quickbooks keep reading.

Visit the Lists option from the main menu. Business owners might use a draw for compensation versus. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each.

As a business owner you are required to track each time you take money from your business profits as a draw or owner salary payment for the purpose of calculating the. In QuickBooks Desktop software. The draw account is for tracking funds taken out use a different equity account for tracking funds in.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. Ad Save Over 51 Hours Per Month On Average By Using QuickBooks. Also you cannot deduct.

This will handle and track the withdrawals of the companys assets to pay an. So your equity accounts could. Heres how you create an Owners Equity account.

If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you take a draw or leave the. Then choose the option Write Checks. Before you can record an owners draw youll first need to set one up in your Quickbooks account.

For a company taxed as a sole proprietor trader I recommend you have the. Heres a high-level look at the difference between a salary and an owners draw or simply a draw. We also show how to record both contributions of capita.

December 10 2018 0530 PM. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. Click on the Banking menu option.

In fact the best recommended practice is to create an owners draw. The business owner takes funds out of the business for. Manage All Your Business Expenses In One Place With QuickBooks.

Click Equity Continue. If you have any video requests or tutorials you would like to see make sure to leave them in the com. Enter the payment and use owner equity drawing as the expense reason for the payment.

A draw lowers the owners equity in the business.

Setup A Draw From Quickbooks Self Employed

Small Business Accounting Checklist 21 Things To Do And When To Do Them Quickbooks Small Business Accounting Small Business Bookkeeping Accounting

How To Setup Quickbooks Online The Ultimate Guide Quickbooks Online Bookkeeping Business Bookeeping Business

8 Often Forgotten Small Business Tax Write Offs Small Business Tax Tax Write Offs Small Business Tax Deductions

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

Quickbooks Self Employed Complete Tutorial Youtube

Solved Owner S Draw On Self Employed Qb

Company Ownership Transfer Letter How To Write A Company Ownership Transfer Letter Download This Company Ownership Tran Lettering Letter Templates Templates

Why I Underprice My Work To Make A Profit Meet Artist Sarah Petkus Animal Drawings Artist Rings For Men

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

Why You Need Quickbooks Online For Your Business Brahmin Solutions

Rose Gold Social Media Icons Sponsored Affiliate Social Gold Icons Media Business Template Social Media Icons Social Media

The Complete Guide To Bookkeeping For Small Business Owners Small Business Bookkeeping Small Business Finance Small Business Accounting

How To Record Owner Investment In Quickbooks Set Up Equity Account

Accept Paypal Payments Quickbooks Desktop Quickbooks Quickbooks Online Paypal

How Can I Run An Owners Draw Report To See The T

Solved Owner S Draw On Self Employed Qb

How Much Does An Employee Cost Infographic Patriot Software Entrepreneur Business Plan Accounting Education Budget Help