foreign gift tax return

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Learn How EY Can Help.

Report Foreign Bank And Financial Accounts Fincen Gov Accounting Financial Bank

Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts is an information return on which the US person discloses to the IRS.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. Person must r eport the Gift on Form 3520. The gift tax return exists to keep US. Form 3520 is an informational return in which US.

For example an American expat receives a. Helping Businesses Navigate Various International Tax Issues. Learn How EY Can Help.

IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate. Also since the giver of the gift is a US resident and the amount of the gift given is 14000 or more they are required to file an IRS Form 709 Gift Tax Return. Form 3520 is an informational return similar to a W-2 or 1099 form rather than an actual tax return because foreign gifts themselves are not subject to income tax unless they.

Persons and executors of estates of US. Person receives a gift from a foreign person that meets the threshold for filing the US. Yes you need to report the gift.

Taxpayer receives a gift from a foreign person trigger an international tax filing requirement. Ad Helping Businesses Navigate Various International Tax Issues. As a result the person giving the gift files a gift tax return.

Learn How EY Can Help. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. For gifting purposes there are three key categories of US.

In addition gifts from foreign corporations or partnerships are subject. The IRS will provide a copy of a gift tax return or the gift tax return transcript when Form 4506 or Form 4506-T is properly completed and submitted with substantiation and. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of.

Therefore the IRS requires the recipient US. The tax applies whether or not the donor. If you fall within these reporting rules you are required to file Form 3520 Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts The.

Certain events such as when a US. Taxpayers report transactions with certain foreign trusts ownership of foreign trusts and receipts of large gifts from foreign entities. The conditions to file Form 3520 does not say.

While foreign gift tax may not be due by the donee a foreign person gift does have a disclosure requirement to the IRS if it exceeds certain thresholds. Person to file a. Decedents file Form 3520.

Basically the disclosure of your foreign. Ad Helping Businesses Navigate Various International Tax Issues. Persons who must file this form.

Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion. Citizens accountable for their annual excludable amount of 15000 and lifetime gift and estate tax exemption of 114 million. Report Inappropriate Content.

Foreign Gift Tax the IRS. Helping Businesses Navigate Various International Tax Issues. About Form 3520 Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.

Receiving foreign gifts and keeping the amount in foreign account. IRS Reporting Requirements for Gifts from a Foreign Person. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and.

American expatriates are subject to gifts tax reporting requirements on US expat tax returns if the aggregate value of foreign gifts exceeds 100000. The tax applies whether or not the donor. Has no tax authority over the foreign person.

Important Practice Tip If you receive a gift. The IRS Form Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts in accordance with Internal Revenue Code Section 6039F is a. Learn How EY Can Help.

A gift tax return is a tax form that needs to be filed by the donor of the gift if they make a transaction of the gift of value exceeding the prescribed limit known as gift tax exemption Tax. Persons who receive gifts from a non-resident alien or foreign estate totalling more than. If you are a US.

For gifts from foreign corporations or foreign partnerships you are required to report the gifts if the gifts from all entities collectively exceed 16388 for 2019. For the same reason if you. You must individually identify.

Tashapb I Will File Your Uk Company Accounts And Tax Return For 110 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

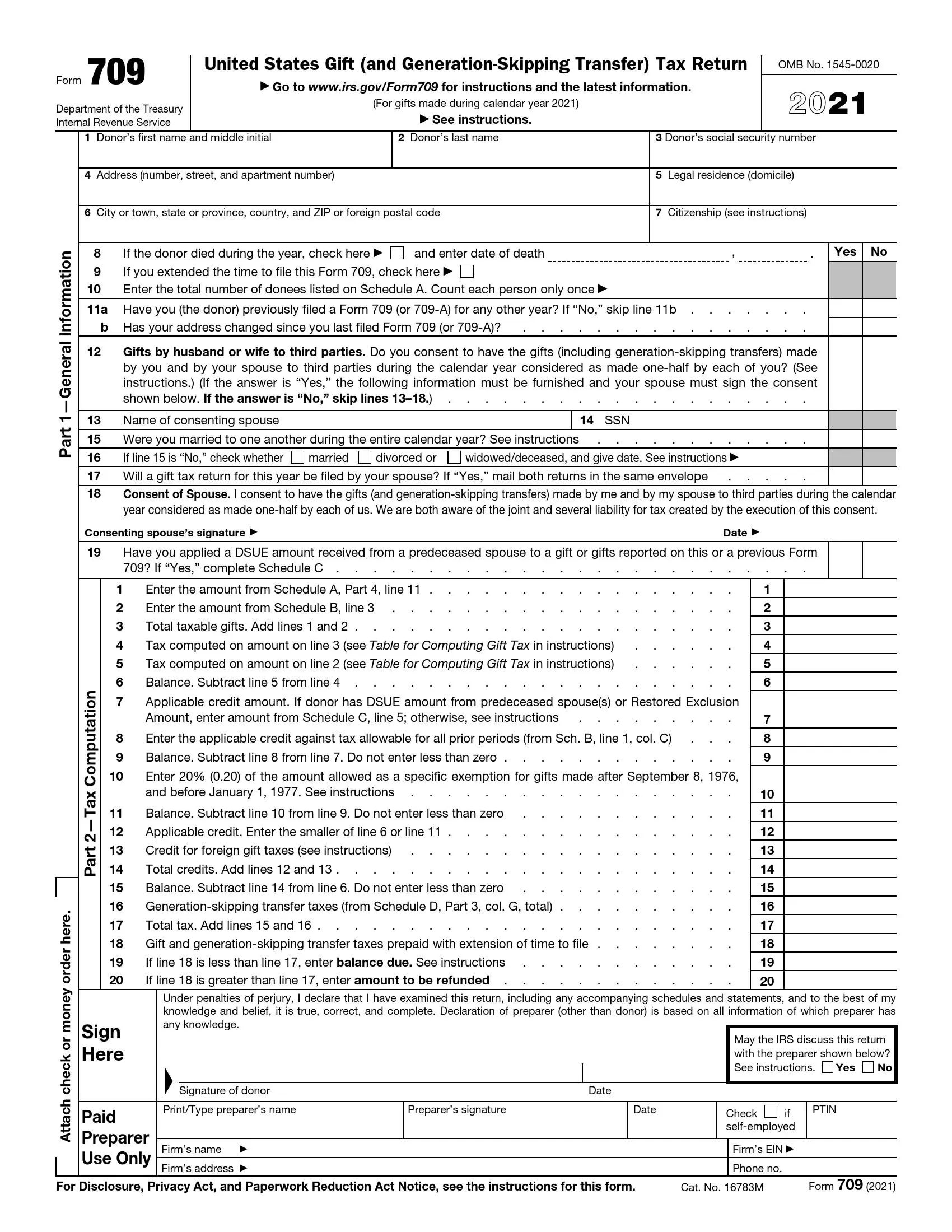

Form 709 United States Gift And Generation Skipping Transfer Tax Return

With The Passage Of The Foreign Investment In Real Property Transfer Act Firpta In 1980 Foreign Nationals Who Sell Gift Or Ot Investing Estate Lawyer Passage

Fillable Form 637 Application For Registration Letter Activities Small Business Tax Employer Identification Number

Irs Form 709 Fill Out Printable Pdf Forms Online

6 Surprising Facts Found In Presidential Tax Returns Through History History

Here S How The New Postcard Sized 1040 Differs From Your Current Tax Return Irs Tax Forms Tax Forms Irs Forms

Form Gift Tax Form Fill Out And Sign Printable Pdf Template Signnow

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Selling Gifted Property In India 5 Important Things You Should Know In Filing Itr This Year Income Tax Return Income Tax Paying Taxes

Corporate Partnership Estate And Gift Taxation 2021 1st Edition Pratt Solutions Manual Pratt Corporate Solutions

Timely Filing The Feie Form 2555 Expat Tax Professionals

Tax Day Party Decorating Ideas Ehow Com Tax Day Debt Relief Programs Irs Taxes

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

F709 Generic3 Worksheet Template Family Tree Worksheet Printable Worksheets